What is life insurance?

Life Insurance can be defined as a contract between a policyholder(you) and an insurance company, where the insurance company promises to payout a sum of money in exchange for a premium, upon the death of an insured person. But what does that mean for you? It means whether you’re purchasing your first home, having your first child, or getting around to final expense & estate planning, PolicyFind will ensure that when you’re no longer here, your loved ones are taken care of. Alleviate financial risk, build financial security, and empower your life & legacy with PolicyFind.

Could Life Insurance be right for you?

Find out here

What are the different types of Life Insurance?

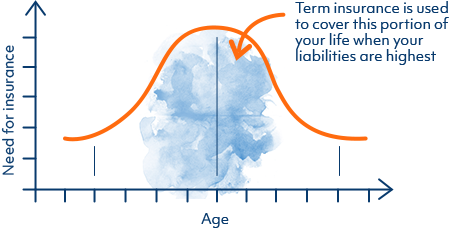

TERM LIFE insurance

Term Life insurance typically provides coverage that expires at a specific age or year. Premiums are guaranteed for the selected term. At the end of that period, the policy is either terminated, renewed, or converted to a permanent policy.

Term Life Insurance policies can be customized and purchased anywhere from 5-40 years.

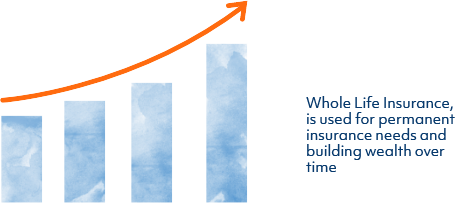

WHOLE LIFE insurance

Whole Life insurance provides permanent death benefit coverage for the life of the insured. In addition to paying a death benefit, certain whole life insurance policies also contain an investment component with guaranteed cash values.

Whole-Life Insurance can be ‘paid-up’ in as little as 10 – 20 years, or you can pay as you go!

NON-MEDICAL insurance

If you’re looking for simple coverage that you can get without medical exams, look no further. We work with Top Insurers to provide Canadians with Simplified & Guaranteed-Issue life insurance products. Call now to speak with an advisor and get a no-obligation quote in 15 minutes or less.

Non-medical life insurance applications can be processed and issued in as little as 24 hours!

Mortgage Insurance:

- Premium is level but the benefit decreases as the mortgage decreases

- If you choose to move to another Financial Institution, coverage is null & void

- Bank is the sole beneficiary of the Mortgage Insurance

Term Insurance:

- Premium is level and the death benefit is ALSO level

- Your individual term insurance plan follows you wherever you go

- You choose who you would like to name as beneficiaries on the Policy

- *Often less-expensive than Mortgage Insurance

The verdict- Term Life Insurance comes out on top! Mortgage Insurance simply does not compete with the value and versatility built into an individual Term Life product. If you’d like to learn more about Term Life insurance, call in at 1.888.212.4212 to find out if Term Life Insurance could be right for you.

The amount of Life Insurance needed for your absolute peace of mind is calculated on a case-by-case basis. Our needs analysis tool generates a recommended coverage amount based on factors such as current liabilities, assets, dependants, outstanding debt, and final expenses. The next step would be to compare rates from over 25 Canadian Insurance Companies using our instant-quoting software.

Alternatively, you can skip the steps above and call in to connect with a Licensed Advisor at 1.888.212.4212. Our team will help you calculate the amount of coverage needed and match you with the insurance company best suited to your financial goals.

Most insurance companies have a guaranteed renewable & convertible clause built into their Term Life insurance policies. This means at the end of your term you may do one of the following:

Renew your Term

o Depending on your age, this option allows you to renew for up to the length of the original term without evidence of insurability (medical requirements).

Convert your Term

o This option allows you to convert a portion, or all, of your Life Insurance face amount to a Permanent Life Insurance policy without evidence of insurability.

Cancel your Term

o If your term policy has served its purpose and is no longer needed, no further action is required on your part- the policy will expire at the end of the term.

Are you nearing the end of your term and need more information on your options going forward? We’ll review your existing policy for free. Call in for a no-obligation consultation with a licensed advisor. You can reach us at 1.888.212.4212.

our life insurance payment options depend on the product you select. Please see below for more information:

Term Insurance

- Payments will coincide with your selected term

- Ex. A term 25 Life Insurance product will be paid either monthly or annually over 25 Years

Whole Life (Permanent)

- Payments can be made as follows:

- Life-pay: you pay for the lifetime of the permanent policy

- 20-Pay: you pay up the entire permanent policy in the initial 20 years (coverage remains in-force once paid-up)

- 10-Pay: you pay up the entire permanent policy in the initial 10 years (coverage remains in-force once paid-up)

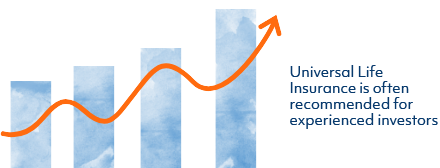

Universal Life (Permanent)

- Payment amount and schedule can be completely customized on a case-by-case basis given the flexibility of this permanent Life Insurance product.

The different payment options pertaining to each Life Insurance product has advantages and disadvantages that must be considered in accordance with your specific financial goals. If you want to know more about which product type and payment option may be best- call in at 1.888.212.4212

Was this helpful?

If you weren’t able to find the answer to your question, please contact us

Speak with an advisor